- Definition of arms length transaction manual#

- Definition of arms length transaction full#

- Definition of arms length transaction rar#

- Definition of arms length transaction code#

Your business is a ‘small’ enterprise if it has no more than 50 staff and either an annual turnover or balance sheet total of less than €10 million. There’s an exemption that will apply for most small and medium sized enterprises. For tax purposes such transactions are treated by reference to the profit that would have arisen if the transactions had been carried out under comparable conditions by independent parties. The ‘arm’s length principle’ applies to transactions between connected parties. The UK’s transfer pricing legislation also applies to transactions between any connected UK entities. It is not possible to decrease profits or increase a tax loss.

/white-measuring-tape-on-arm-516451722-a7d5f49c18474497aef1d18b9f12a9e2.jpg)

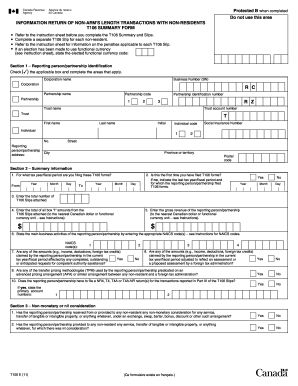

The UK legislation allows only for a transfer pricing adjustment to increase taxable profits or reduce a tax loss. The following reference table summarizes the exclusion criteria related to RP-5217 form items.The UK’s transfer pricing legislation details how transactions between connected parties are handled and in common with many other countries is based on the internationally recognised ‘arm’s length principle’.

Definition of arms length transaction rar#

Parcel is not residential (exclude from RAR only).Significant Change has been indicated (Condition "G").

Definition of arms length transaction full#

Full Sale Price minus Personal Property is less than $10,001. An arm’s length transaction, also known as the arm’s length principle (ALP), indicates a transaction between two independent parties in which both parties are acting in their own self-interest.ORPTS will exclude an arm's length sale for ratio purposes if: It is used specifically in contract law to arrange an agreement that will stand up to legal scrutiny, even though the parties may have shared. Such a transaction is known as an 'arm's-length transaction'. Ratio exclusions are based on part of parcel, multiple parcels, multiple towns, condo, significant change, full sale price - personal property < $10,001, total assessed value = 0. The arm's length principle ( ALP) is the condition or the fact that the parties of a transaction are independent and on an equal footing. If sale is determined to be non-arm's length, it is then automatically excluded for ratio purposes.

Definition of arms length transaction code#

Condition "I" requires an acceptable explanation and should be submitted as directed in Submitting Condition Code "I" Corrections.When "J" is present on RPS035 file or paper correction, any other Condition Codes are erased/deleted. Exception is "J" - No Conditions Apply.This does not impact arms-length nature of sale, only "ratio" usability. Exception is "G" - Significant Change.Conditions of Transfer are present, item 15 on the RP-5217 form.More than 1 year elapsed between the Contract Date and the Sale Date.Full Sale Price minus Personal Property is less than or equal to $10.00.ORPTS will exclude a sale as non-arm's length if: Arm's length determinations are made based on conditions of transfer, full sale price vs. There are two types of exclusion criteria:Īn arms length sale refers to a real estate transaction in a open market freely arrived at by normal negotiations without undue pressure on either the buyer or seller. Sales are included or excluded from use in ORPTS products based on sales exclusion criteria. These sales are not considered representative of true market conditions.Īssessment officials should see the ORPTS's sales exclusion criteria document for more detailed information. For example, all sales equal to or below $10.00 are automatically excluded from any sales related study. This is done to insure that certain transfers are excluded from use in state programs, studies, and resulting products. State Board of Real Property Tax ServicesĮxclusion determinations are made for each real property transfer.Standards for electronic real property tax administration.Interest rates on court-ordered property tax refunds.Interest rate on late payment of property taxes.Real property tax legislation summaries.Equalization for coordinated assessment programs.

Definition of arms length transaction manual#

0 kommentar(er)

0 kommentar(er)